(Bloomberg) — The Israeli city of Ofakim is just a short distance from Gaza, where war has been raging for eight months. But it will take until now for the inflationary consequences of the conflict to materialize.

Most read from Bloomberg

As tens of thousands of people fled areas near Israel’s southern and northern borders following Hamas attacks on October 7, the housing stock shrank by almost 5% overnight, a setback for an economy whose cost of living has the war already exceeded that of Switzerland as the most expensive. among the 38 member states of the OECD.

After spending months in hotel rooms, many evacuees are now starting to rent long-term – just as there is already a housing shortage. For Shahar Zvolon, a resident of Ofakim, this has helped increase her rent by 30%, an expense that makes up more than a quarter of Israel’s monthly consumer price package.

Israel’s worst armed conflict in half a century has set off an inflationary chain reaction that is finally coming into view. “Help, we’re out of air, we’re collapsing,” blared a headline on the popular news website Walla in June – a call for help against inflation as public outrage mounts.

The initial shock to consumer spending was so large that it prevented inflation from accelerating despite disruptions in the economy. But as domestic demand recovers, the costs of everything from groceries to travel are rising.

Growing price pressures have reversed a six-month slowdown in inflation, which likely rose above the official target of 1%-3% in May for the first time this year. The last monthly lecture appears on Friday.

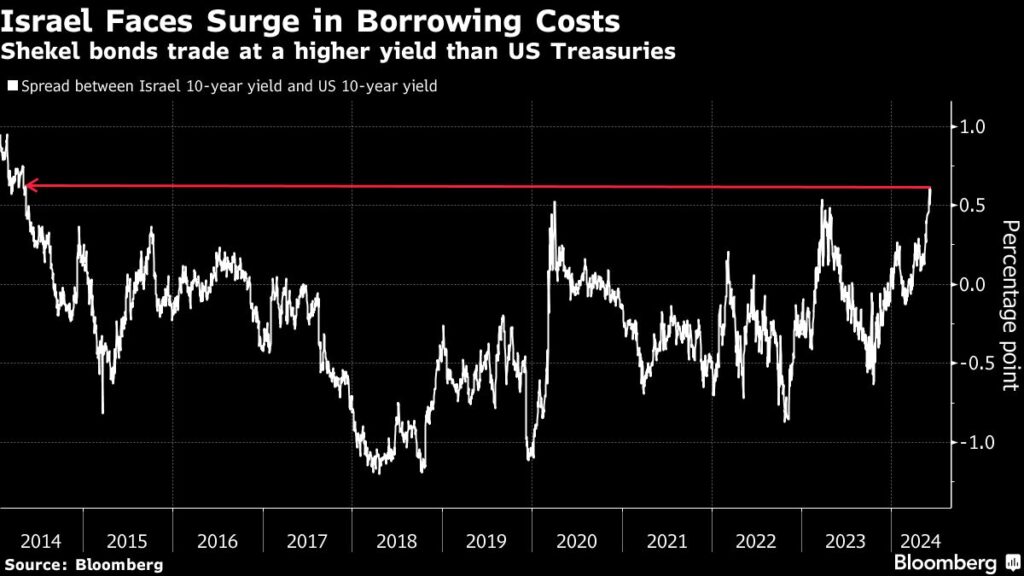

The gloomy outlook also rewrites the timeline for the central bank’s plans to further ease monetary policy, threatening to keep borrowing costs higher for longer just as the government looks to the debt market to finance most of its massive spending needs.

Inflation momentum will be harder to slow as unemployment returns to near pre-pandemic lows and wages will rise by nearly 8% in the first two months of 2024. Higher taxes and energy costs – combined with expansionary fiscal policy and a more volatile shekel – are also putting pressure on prices.

The Finance Ministry now expects inflation to end the year at 3.3%, almost a full percentage point higher than the central bank forecast in January. The biggest contributors are housing, transportation and food – categories that together account for more than half of Israel’s consumer price basket.

Rising food prices are a particularly clear example of how the echoes of war are resonating through the economy.

Once fighting broke out, demand surged as people wanted to stock up on food, while the government increased its own purchases to care for soldiers and other security forces. In the first weeks of the war alone, food prices rose by an estimated 2%.

There has been little easing since then. About half of Israel’s 29 largest food companies – local producers and importers – have increased prices by as much as 30% since January.

Amid gun battles, access has been restricted to as much as a third of Israel’s agricultural land, according to BDO Consulting, further unsettling an agricultural sector whose workforce has shrunk by 40%.

A freeze on exports by Turkey, higher global commodity prices and rising transport costs due to Houthi attacks on shipping in the Red Sea made matters worse.

“This has increased dependence on imports, which in turn have become more expensive due to rising transport costs and Turkey’s trade ban on Israel,” said Chen Herzog, chief economist at BDO Consulting.

Spillovers to the rest of the economy have pushed restaurant prices up by more than 3% in each of the past four months.

The head of a restaurant owners association recently admitted that he violated competition laws by trying to collude with colleagues and raise prices by at least 5-10%, arguing that profitability in the business “has eroded and the prices need to be updated’.

Industries like aviation are facing similar pressures, a concern because transportation and communications have the second highest inflation weight after food.

The number of international airlines with flights to Israel has fallen by a third since the start of the war, reducing the average number of daily flights by 40%. As a result, airline tickets were the biggest driver of inflation in April, up 11%.

As more people return from reserve service to the military, demand is expected to continue to grow.

“Airlines are looking for certainty,” said Nir Mazor, deputy head of tourism company Kishrey Teufa. “The next chance for their return is October. If matters are not resolved by then, it may be postponed until April 2025.”

The housing market shows why relief from inflation is likely still some way off.

A ban on Palestinian workers means an estimated one-third of construction sites will remain closed, while a sharp drop in productivity will hurt the rest. More than two-thirds of Palestinians who worked in Israel before the war worked in construction.

The risk is that the supply of new housing will not recover for at least the next two years, forcing more potential buyers to rent – just as an increasing number of Israelis displaced by the war are looking to settle.

As hostilities intensify with Iran-backed Hezbollah on Israel’s northern border with Lebanon, more than half of those who have left the area say they have no intention of returning, a Ruppin Academic Center poll shows.

The price for an average apartment in Israel was 3.1% higher in the first quarter than in the previous three months. Compared to pre-war levels, the cost of renting a three-bedroom home has risen by 6% in Tel Aviv and 13% in Jerusalem, according to data from real estate website Madlan.

“The fact that northern residents have been away from home for more than six months, with no end in sight, is causing many of them to look for long-term housing solutions in safer locations,” says Tal Kopel, head of Madlan. “And this puts pressure on the rental market.”

While political emotions have long run high over the cost of living in Israel, the government’s wartime priorities lie elsewhere with the budget under pressure from defense spending. To stabilize public finances, a percentage point increase in VAT will come into effect in January.

The political blame game over inflation is already in full swing.

Finance Minister Bezalel Smotrich and Economy Minister Nir Barkat have been criticized for being “a complete failure when it comes to the cost of living” by Moshe Gafni, a fellow member of the ruling coalition.

The government’s lack of action could have consequences, especially after a surprise surge in prices in April, said Idan Azoulay, chief investment officer at Sigma Investment House.

“Not hearing even a faint voice saying that price increases will be investigated and action can be taken could in itself accelerate the increases,” he said.

(Updates with restaurant prices from the 16th paragraph.)

Most read from Bloomberg Businessweek

©2024 BloombergLP