(Bloomberg) — The Swiss government has proposed raising sales taxes by 0.7 percentage points from 2026 to pay for an increase in pensions, which was backed by voters in a plebiscite earlier this year.

Most read from Bloomberg

The change, which needs parliamentary approval and must be approved in a referendum, would raise the overall rate from 8.1% to 8.8%, the government said in a statement on Wednesday.

The lower level of sales tax on hotels would rise from 3.8% to 4.2%, while that on daily necessities would rise from 2.6% to 2.8%. The increases would apply from January 2026.

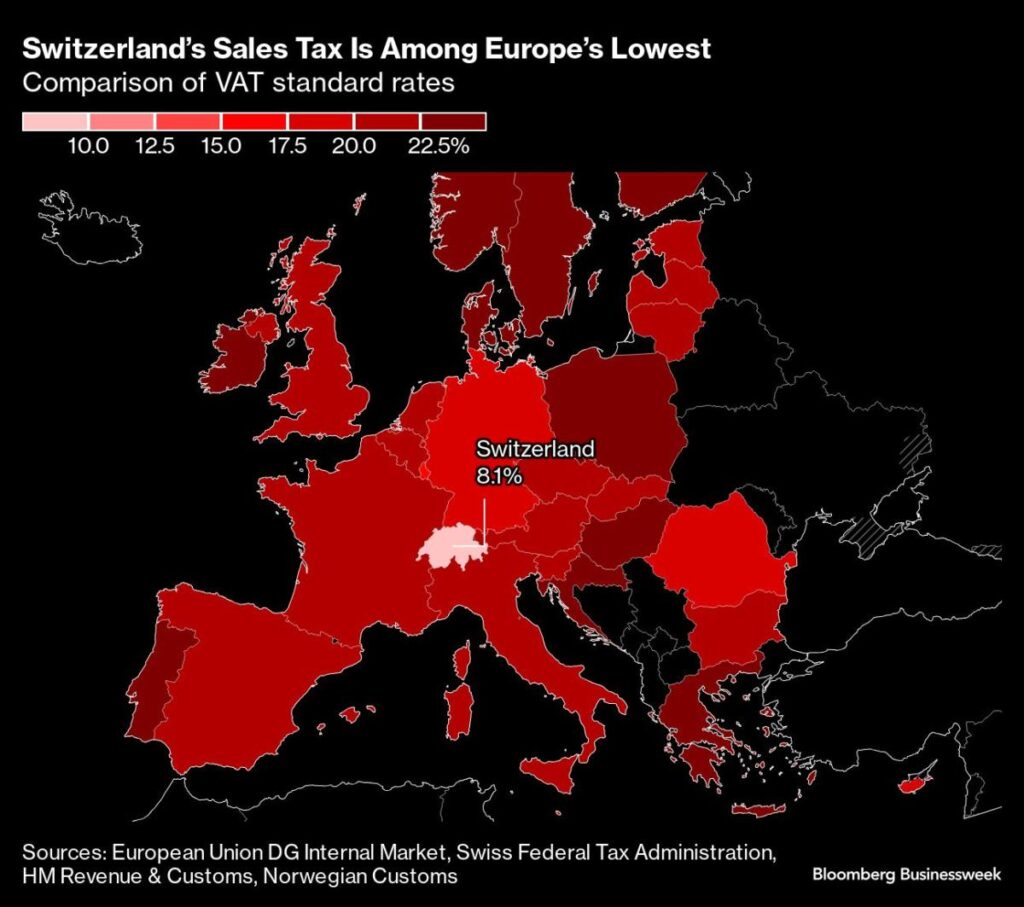

Swiss voters in March backed a proposal to introduce a 13th annual payout to pensioners, the first time in the country’s history that social benefits have been increased through plebiscite. The government said it preferred raising sales tax rates, which are among the lowest in Europe, to increasing wage contributions to finance the change.

The government said separately on Wednesday that it will reduce the amount of goods that shoppers can bring into Switzerland from neighboring countries such as France, Germany, Italy and Austria without tariffs.

The daily duty-free limit for importing groceries and other goods will be halved from 300 francs per person to 150 francs ($174), the government said.

The change, which does not require parliamentary approval, will come into effect from January 1.

Swiss consumers pay the highest food prices in Europe and a system of tariffs designed to protect the agricultural sector effectively blocks cheaper imports. This makes shopping across the borders of the landlocked country attractive to many people.

(Updates with graphs after the third and sixth paragraphs.)

Most read from Bloomberg Businessweek

©2024 BloombergLP