(Bloomberg) — The French government is exploring targeted taxes on the wealthy and big corporations in an effort to shore up its finances without undoing President Emmanuel Macron’s growth-boosting reforms, recently appointed Finance Minister Antoine Armand said.

Most read from Bloomberg

His comments come as investors pull out of French assets amid political unrest, with the risk premium on the country’s sovereign debt approaching its highest level since the eurozone crisis.

“Apart from one or two years of exceptional crisis in the last 50 years, we have one of the biggest deficits in our history,” Armand told France Inter Radio on Tuesday.

“The question we have to ask ourselves is how everyone can contribute intelligently, given the seriousness of the fiscal situation,” he said, adding that possible additional taxes should not hamper growth and employment.

Armand confirmed that Prime Minister Michel Barnier’s administration will not increase taxes on working people and the middle class, but said making the rich pay a minimum amount of tax was “an interesting option”.

The government is under pressure to find quick solutions to the country’s fiscal challenges and must present a 2025 budget bill to parliament in the coming weeks. Barnier said on Sunday he would impose higher taxes on the country’s biggest companies and wealthiest individuals in a bid to tackle the country’s huge budget deficit.

A measure of the risk in French bonds — the spread between French and German 10-year yields — is at its highest since concerns about the country’s politics peaked this summer. Citigroup expects it to widen to as much as 100 basis points next year, from around 80 now. Meanwhile, French stocks have fallen more than 6% since President Emmanuel Macron called snap elections on June 9.

The budget calibration is crucial to restoring investor confidence. France has strayed so far from its long-term deficit-reduction plans that it would take a massive effort to get back on track to meet a deficit reduction target within the European Union’s limit of 3% of economic output by 2027.

Bank of France Governor Francois Villeroy de Galhau has said that such rapid consolidation would no longer be credible or sensible and that the new government should instead negotiate with the EU on an adjustment spread over five years. According to the member of the European Central Bank Governing Council, most of the effort should come from austerity, although targeted taxes that do not damage economic confidence should also be used.

Tax hikes are a contentious issue even in Barnier’s new cabinet, as lawmakers are reluctant to roll back seven years of Macron’s pro-business policies that they say have restored France’s economic fortunes. Yet opposition parties in parliament have made raising taxes on the wealthy a cornerstone of their economic proposals.

Barnier will provide more clarity on his plans when he presents his policy agenda to parliament on 1 October.

“Today the markets are giving France the benefit of the doubt and there are all the ECB mechanisms, but if France were to say ‘forget all that and let’s let the budget deficit rise’, we would quickly find ourselves in a much more serious crisis,” said Michala Marcussen, chief economist at Societe Generale. “But for fiscal consolidation to work, it has to be seen as fair, with everyone contributing in some way.”

Patrick Martin, head of the French business lobby Medef, told Franceinfo radio on Tuesday that companies could accept more tax increases as long as the state made greater efforts to cut spending.

What Bloomberg Economics Says…

“If the Barnier government can deliver a credible fiscal strategy that reassures markets and largely complies with EU rules, this could bolster confidence in France’s economic direction. However, given the political fragility and ambitious fiscal targets, the path ahead is fraught with risks.”

—Eleonora Mavroeidi, economist. Click here for full INSIGHT

“If necessary, exceptionally and temporarily, companies can contribute to a limited extent,” he said.

Tax-the-rich policies would mark a significant change in France after President Emmanuel Macron came to power in 2017 promising to repair France’s relationship with business. Among his first moves was to reduce the size of the country’s wealth tax and introduce a flat levy on capital, earning praise from the business community and rebukes from opponents who dubbed him the “president of the rich.”

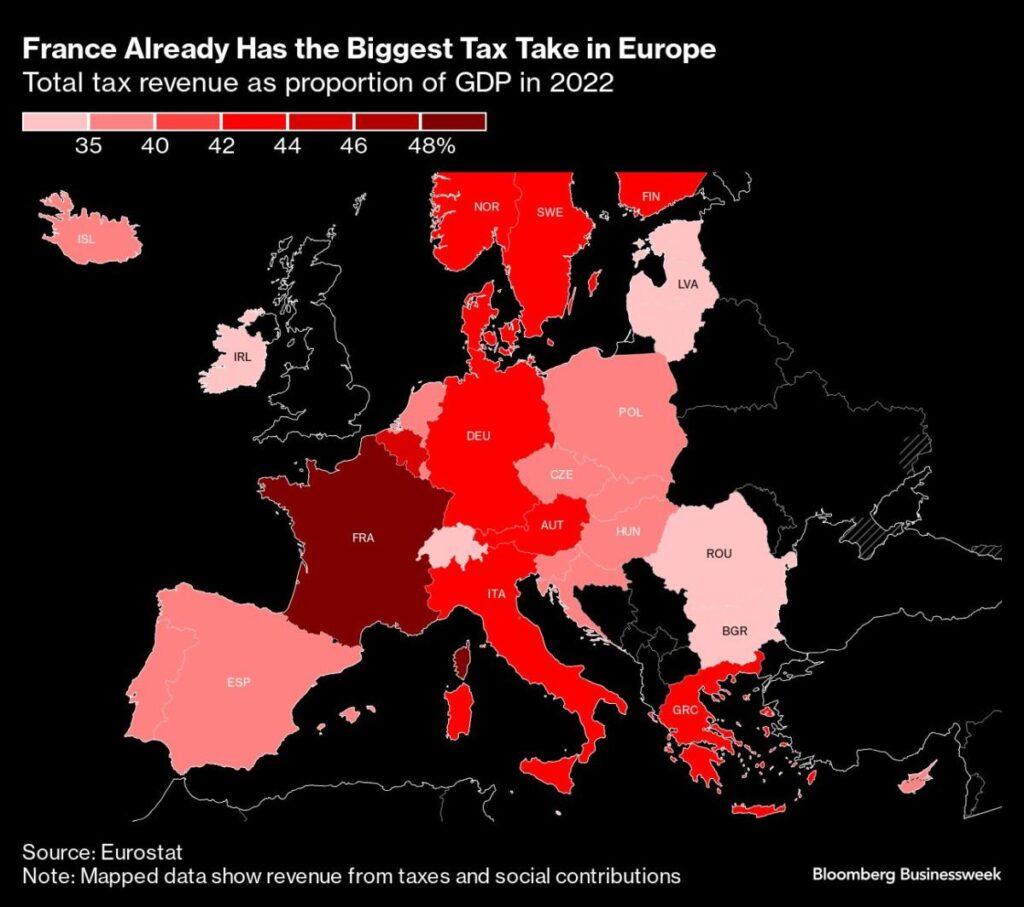

Overall, France remains the European country with the highest tax revenues as a percentage of economic output.

–With assistance from Benoit Berthelot.

(Updated with economist’s comment in paragraph 12.)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP