(Bloomberg) — Air-France KLM is lobbying the French government to limit the number of flights that mainland Chinese airlines can make to Europe, according to people familiar with the matter, in an effort to protect European airlines from unfair competition .

Most read from Bloomberg

The Paris-based aviation group’s requests could include asking for a suspension of current air traffic rights between France and Asia’s largest economy, some people said. They asked not to be identified because the discussions are private.

Deutsche Lufthansa AG, meanwhile, is urging the German government to take the lead in challenging Beijing on the issue of distorted rivalry, another person said.

Lufthansa has already said it will scale back flights to China and plans to scrap its direct daily flight from Frankfurt to Beijing at the end of this month, saying it needs to use fuel-guzzling older planes on that route amid a plane shortage. deployment, making it unprofitable.

Such machinations expose the disagreement among European airlines over how best to curb the rising number of flights from China as Chinese airlines take shortcuts over Russian airspace, saving precious hours on long-haul trips and offering much cheaper ticket prices. There is some debate over whether national governments should be involved or whether the matter should simply be shifted to Brussels, the de facto capital of the European Union, the people said.

Representatives for Air-France KLM and Lufthansa did not respond to requests for comment.

More broadly, Europe’s relationship with China has been roiled by rising trade tensions as the EU tries to target what it says are unfair subsidies and other support that Beijing offers to its companies. The bloc is imposing tariffs on Chinese-made electric vehicles, while China is threatening to retaliate against imports of cognac and vehicles with large engines.

KLM CEO Marjan Rintel spoke out earlier this month and urged action from the European Union against ‘unfair’ Chinese competition, WNL TV reported. “Europe can at least look at how we can prevent that unfair playing field by putting a price on it or looking at it in a different way,” Rintel said.

European airlines have not flown over Russia since the beginning of Moscow’s invasion of Ukraine in late February 2022. Since then, Ukrainian airspace has also been closed. That gives Chinese rivals a clear advantage in terms of costs and hours in the air.

It is not the first time that legions of flights from China have caused problems for other countries. The US moved during the Covid-19 crisis to curb the glut of Chinese airlines flying into the country with unfettered access while US airlines were stymied, leading authorities on both sides to limit the number of flights.

Lufthansa has said it is losing as much as half a million euros ($550,000) on each of its soon-defunct flights from Frankfurt to Beijing. China’s three largest airlines have now secured 111.1 billion yuan ($15.7 billion) in subsidies or government subsidies to encourage them to operate air links, the airlines’ annual reports show.

Lufthansa and Air France-KLM also usually codeshare on flights to China with Air China Ltd. and China Eastern Airlines Co., and Shanghai-based China Eastern has a 4.7% stake in the French-Dutch airline group.

However, Air France-KLM and China Eastern suspended their codeshare partnership due to the pandemic as international travel dried up and never restarted, one of the people said.

British Airways and Virgin Atlantic Airways Ltd. have also eliminated some Chinese routes, with Virgin suspending flights between London Heathrow and Shanghai from October.

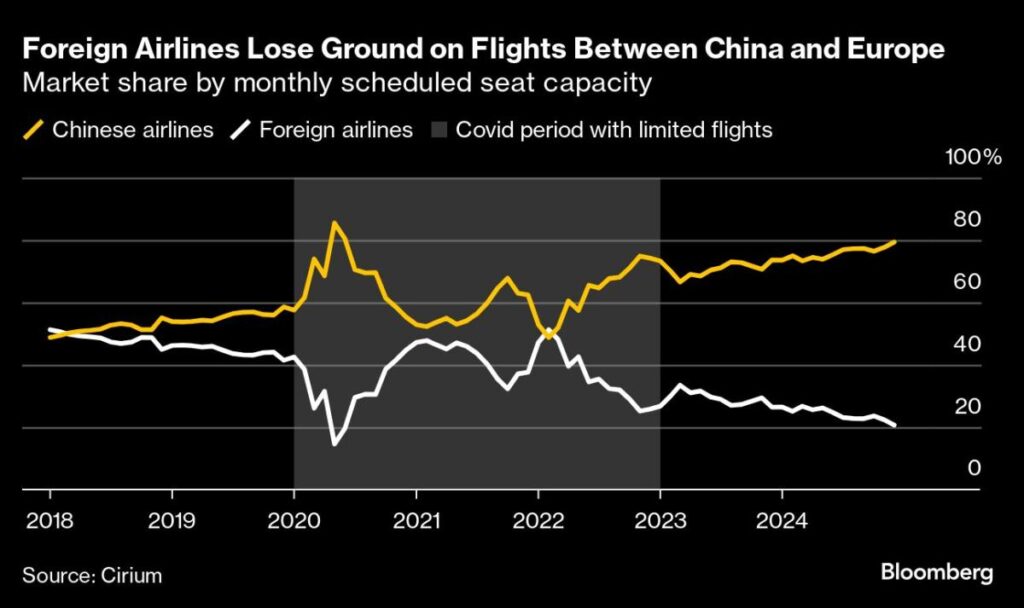

In the wake of Covid, European airlines have been slow to restore flights to China, largely due to lackluster outbound demand from Europe. However, Chinese airlines have added many flights, well above 2019 levels, and are offering very competitive airfares.

By the end of the year, Chinese airlines will account for about 75% of seat capacity on all flights to and from Germany and France to China, according to data from aviation company Cirium. And they will have 100% of the market for travel to Italy and a 95% share of flight capacity to Britain.

–With help from William Wilkes, Jinshan Hong, Josh Xiao, and Albertina Torsoli.

Most read from Bloomberg Businessweek

©2024 BloombergLP