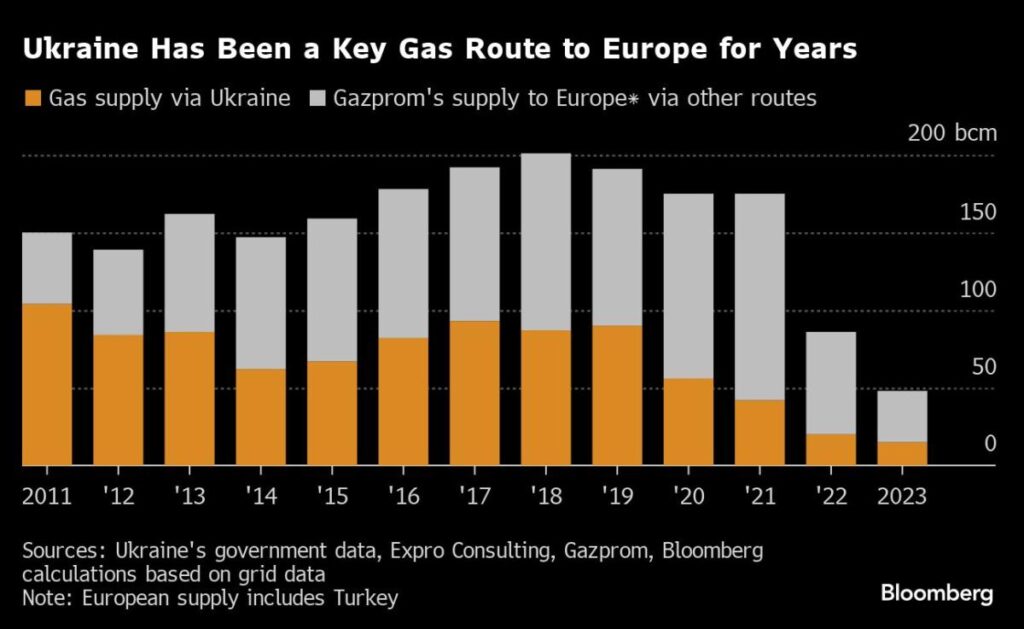

(Bloomberg) — With more than 14,000 miles of natural gas pipelines, Ukraine has been a major player in Europe’s energy markets for decades. But by the end of the year, those strategic assets could be stranded.

Most read from Bloomberg

As talks intensify ahead of the heating season, an agreement between Moscow and Kiev to move Russian gas to Europe is unlikely to be extended before it expires in December. That would halt flows that have continued more than two years after the large-scale invasion and hit the market at a critical time.

“The end of transit through Ukraine really marks the end of an era that had been slowly simmering,” said Margarita Balmaceda, a professor of international relations at Seton Hall University who specializes in the energy policies of the former Soviet states.

For the continent’s tense energy markets, it means more uncertainty, while Russia would lose one of its two remaining pipeline routes to Europe for its gas. But Ukraine may have the most at stake, losing money to help maintain its energy infrastructure and its long-held strategic position as a conduit for affordable energy for Western allies.

For more than five decades, gas flows have been a key element between Russia, Ukraine and Europe. Since the fall of the Soviet Union, tensions over transit have been part of Russia-Ukraine relations. Disputes led to supply cuts in 2006 and 2009, leaving several European customers disconnected for days due to freezing temperatures.

The current transit deal between Ukraine’s state energy company Naftogaz JSC and Russia’s Gazprom PJSC was agreed in late 2019, when Europe’s energy map looked very different. Flows via the route now account for less than 5% of the continent’s supplies, but that’s still enough to have an impact on energy security.

The bitter reality for Ukraine now is that no one needs a renewal of the gas transit pact more than Kiev. Financially, the country risks losing as much as $800 million a year in transit fees, according to estimates by Mykhailo Svyshcho, an analyst with Kiev-based ExPro Consulting. That’s already about a third of what it used to be.

While that is small compared to the billions Russia has lost to European customers since the 2022 invasion, it may take more than a revival of the pact to get the flows moving again after the Kremlin sought to weaponize energy links.

Most customers have found alternatives. After relying on Russian gas for more than half of its needs before the invasion of Ukraine, Germany increased pipeline deliveries from Norway and expanded facilities to import liquefied natural gas from around the world. It is now independent of imports via Ukraine’s pipelines.

That said, the door is not completely closed. With Germany’s manufacturing sector under pressure, some opposition parties and business leaders are calling for a return to cheaper pipeline supplies from Russia. The route via Ukraine would be the most viable after the Nord Stream pipeline to Germany was sabotaged in September 2022.

Austria and Slovakia — the main recipients of the fuel still flowing through Ukraine — say they are ready to switch from Russia-linked pipelines. Slovakia’s largest gas supplier, SPP, said it was in a comfortable position for the winter. Austria expects gas through Ukraine to stop in January, and the government in Vienna hopes that will allow it to break contracts with Gazprom.

Moscow does have other routes available to sell gas, however, including pipelines via Turkey, expanding connections to China and LNG cargoes. But pipeline routes to Europe are limited — with networks closed after the war due to damage or sanctions — and a loss of Ukrainian volumes amounts to about $6.5 billion annually at current prices, Bloomberg calculations show.

That is a strong incentive for the Kremlin to renew the deal. President Vladimir Putin left the door open last week, saying he is ready to continue gas transit through Ukraine after 2024.

Despite Ukraine’s desire to maintain the network’s relevance, it is trying to adhere to red lines. President Volodymyr Zelenskyy has pledged to remove “Russian molecules” from the country’s transit network in order to cut off the flow of money to the Kremlin. Instead, Kiev is looking to other suppliers to exploit the assets, but a lack of Russian gas in the system could make the network even more of a military target than it already is.

Ukraine has held transit talks with Azerbaijan, which already supplies gas to eight countries in Europe. Ilham Aliyev, the Caspian Sea nation’s president, said last week that talks were underway to supply the fuel to at least three other markets in Europe.

According to Anne-Sophie Corbeau, a researcher at the Center on Global Energy Policy at Columbia University, the reality is that Azerbaijan’s gas production is not sufficient in the short term to be a full substitute. Any replacement deal would likely include Russian gas.

“Flows at the same level as Azerbaijani gas would be a direct cover-up of Russian gas,” she said.

Agreements with Kazakhstan and other suppliers in Central Asia could also be an option, but time is running out to formulate a plan before the agreement expires.

With energy supply and demand still in tight balance, the almost certain loss of the route via Ukraine could cause volatility in European markets. Disruptions in Norway or problems with LNG shipments could, combined with a cold snap, send prices soaring.

“There could still be a shortage during this heating season,” says Frank van Doorn, head of trading at Vattenfall Energy Trading GmbH. “Realistically, we haven’t been tested yet, as the last two winters were mild.”

–With assistance from Daniel Hornak, Jonathan Tirone, Dave Merrill, and Olga Tanas.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP