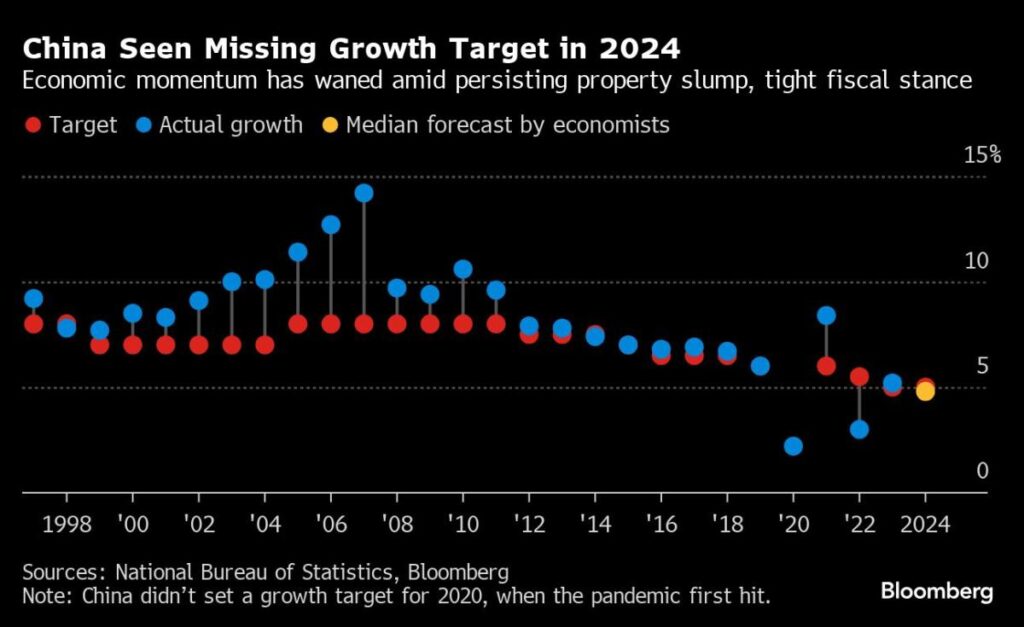

(Bloomberg) — In January, Premier Li Qiang announced that China had managed to exceed its 2023 growth target without resorting to “massive stimulus measures.” It now appears less likely that the same feat will be repeated this year.

Most read from Bloomberg

Pressure is mounting on China’s authorities to quickly ramp up fiscal and monetary stimulus to meet this year’s growth target of around 5%. Data released on Saturday showed industrial production last month suffered its longest slowdown since 2021, while consumption and investment weakened more than expected.

Hours before the announcement, the People’s Bank of China issued a rare statement and reported disappointing credit data indicating that the fight against deflation would be given higher priority and that more monetary easing would take place in the future.

“This set of data calls for aggressive fiscal expansion to shift expectations and revive confidence in the economy,” Hao Hong, chief economist at Grow Investment Group, wrote on social media platform X. “Otherwise, we would be dozing our way into ever-deepening gloom.”

The deterioration tests President Xi Jinping’s tolerance for missing a key target as he balances growth with avoiding the massive stimulus that fueled previous boom-and-bust cycles. Missing the target could further undermine confidence in the world’s second-largest economy, as foreign investors already pulled a record amount of money out of China in the second quarter.

The August data added to evidence that China’s economy has weakened since gross domestic product growth slowed to 4.7% in the three months through June, the worst pace in five quarters and — crucially — below Beijing’s annual target of around 5%.

The focus now turns to the October third quarter reading. Data so far suggests GDP will grow 4.6%-4.7% for the period, estimates Jacqueline Rong, chief China economist at BNP Paribas SA.

Analysts at Macquarie Group Ltd., including Larry Hu, expect full-year growth to reach that level if the current momentum continues into December, “missing the target of around 5%.” Goldman Sachs Group Inc. over the weekend cut its GDP forecast for this year to 4.7%, adding to the doubts.

That would be the second time in three years that China has missed its target. Covid lockdowns in 2022 led to the biggest failure since the government began setting GDP targets in the early 1990s.

President Xi appeared to show tolerance for a rate slightly lower than 5% last week when he urged officials to implement existing policies to “strive to achieve” the full-year targets. That language seemed less forceful than a call in July to “resolutely” meet the goals.

“He avoided putting too much pressure on officials to achieve 5% growth,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. “As long as they implement the policy faithfully, a growth rate that is ultimately a little bit lower than 5% would be acceptable, I think.”

Xi made the remarks during a meeting of several Communist Party leaders in the northwest of the country, Gansu. Gansu is one of twelve provinces that the central government says have an alarmingly high debt burden.

Once a major growth engine, provinces have become more cautious about spending. Their issuance of new special bonds in the first eight months of the year was at the slowest pace since 2021. That left local officials with about 1.4 trillion yuan ($197 billion) of this year’s quota yet to be tapped, according to data compiled by Bloomberg.

While the central government could step in and repeat last year’s rare ad hoc budget revision to unleash more spending, time is running out to salvage the 2024 target. Analysts are predicting further rate cuts and a reduction in the amount lenders must hold in reserves, with September seen as a window.

“Even if additional stimulus is introduced today, the impact on growth over the year may be limited,” Ding added. “I think leaders may come to the reality that there is only about a quarter left this year.”

Part of the problem is the ongoing real estate crisis, which Barclays Plc estimates has caused Chinese households to lose some $18 trillion in wealth. Real estate investment fell by double digits in August, according to estimates by economists at Nomura Holdings Inc., including Lu Ting.

Deflation is also becoming more entrenched. The risks are underscored by the decline in private investment in the first eight months of the year as companies embroiled in price wars struggled to turn a profit.

The PBOC on Friday reiterated a pledge made by Governor Pan Gongsheng in June to “make maintaining price stability and pushing for a mild recovery in prices an important consideration.” However, the PBOC did not repeat Pan’s comment about “maintaining a cautious policy” or avoiding drastic measures.

“The central bank may have made fighting deflation a higher priority,” BNP’s Rong said. Policy may be “more” focused on stimulating household spending as the PBOC also emphasizes consumption and investment, she added.

But no matter how bad the data looks, policymakers are likely to hold off on aggressive stimulus as long as the economy generally holds up. Exports hit their highest in nearly two years last month, even as China faces a rising wave of tariffs from the U.S. and European Union.

“It is unlikely that China’s senior policymakers have stopped caring about growth,” said Louis Kuijs, chief Asia Pacific economist at S&P Global Ratings. “But it is hard to say how weak the economy would have to get before they would agree to more expansionary fiscal policy.”

Most read from Bloomberg Businessweek

©2024 Bloomberg LP