(Bloomberg) — Both of Britain’s major political parties are refusing to address chronic public service problems and looming economic risks as the election turns into major rows over small pledges, two of the country’s top think tanks warned.

Most read from Bloomberg

In comments made shortly before the first televised leadership debate on the campaign, the Institute for Fiscal Studies accused the ruling Conservatives and Labor opposition of ‘avoiding reality’. The Resolution Foundation said politicians “must have a plan that is credible, given the much tougher budget environment they could face in the next parliament, and the difficult choices this would entail.”

Prime Minister Rishi Sunak will go head-to-head with Labor leader Keir Starmer at 9pm on ITV, when the economy, defence, migration and the state of public services such as health and justice are likely to be hotly debated. Both parties essentially signed the same budget rules, leaving them no room to maneuver unless they raise taxes or find other savings.

The resolution warned that the next government will inherit a £12 billion ($15.3 billion) hole in public finances should even small economic risks materialize. If major cuts to public services planned for 2025 are scrapped, £33 billion in savings would be needed. Real daily public service expenditure per person is 6% below 2009-2010 levels and struggling smaller departments such as transport are facing cuts of 19% in a new round of cuts.

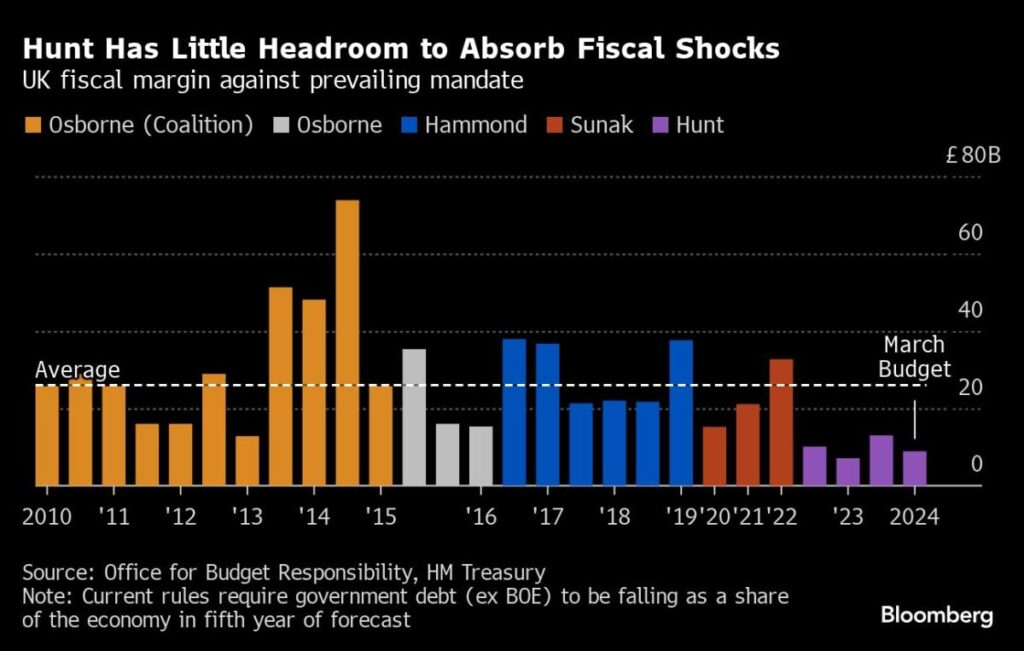

The Conservatives’ budget line is to reduce debt as a percentage of national income in the fifth year of the forecast and keep annual borrowing below 3% of GDP. Labor uses the same debt rule and would pay all day-to-day expenses from income, borrowing only to invest.

In March, the Office for Budget Responsibility ruled that the Tory Chancellor of the Exchequer, Jeremy Hunt, was complying with his rule with £8.9 billion to spare. Labor plans to invest £23.7 billion in green industries over five years and will raise around £5 billion annually by taxing private school fees and private equity. The IFS said the opposition party would meet its debt target “fairly”.

Both sides are hoping that growth and rate cuts will come to the rescue, but Isabel Stockton, senior research economist at IFS, said: “Anyone who is serious about government should not rely on getting lucky.”

The Resolution warned that even small economic changes could push public finances off course. “A modest downward revision to the OBR forecast for productivity from 1.1% to 0.9% per annum would add around £17 billion per annum to borrowing by the end of the forecast period,” the report said.

The government’s agreed compensation for victims of infected blood products will cost £10 billion over the next five years. Should interest rates be one percentage point higher than predicted, this would add £12 billion a year to borrowing, Resolution said.

James Smith, research director at Resolution, said: “The state of public finances has dominated the election campaign so far, with the inevitable arguments over how each spending promise is funded. But this narrow focus risks distracting the electorate from the larger question of how each party deals with the uncertainties facing public finances.”

“The parties must explain how they intend to tackle these challenges, while rightly advocating an economic strategy that would stimulate growth.”

Most read from Bloomberg Businessweek

©2024 BloombergLP