(Bloomberg) — French President Emmanuel Macron approved a temporary tax on the country’s biggest companies, backing his new government’s strategy even as it diverges from his long-standing pro-business stance.

Most read from Bloomberg

The French government on Wednesday announced plans for around 60 billion euros in spending cuts and tax increases next year, in a bid to rein in a widening budget deficit and boost investor confidence in the country.

Just under €20 billion will be generated by increasing government revenues, with tax increases on wealthy individuals and large corporations, and through higher green taxes.

“Having exceptional corporate taxation is something that big companies understand well if it is for one year, given the effort that needs to be made,” Macron said during a panel discussion with Bloomberg’s Stephanie Flanders at the Berlin Global Dialogue. “But it must be limited, we must not forget the reality of our economy, the reality of our competitiveness and our position.”

Macron’s support is in stark contrast to the previous seven years of his presidency, when economic policy was defined by a pro-business mantra based on avoiding increases in the tax burden.

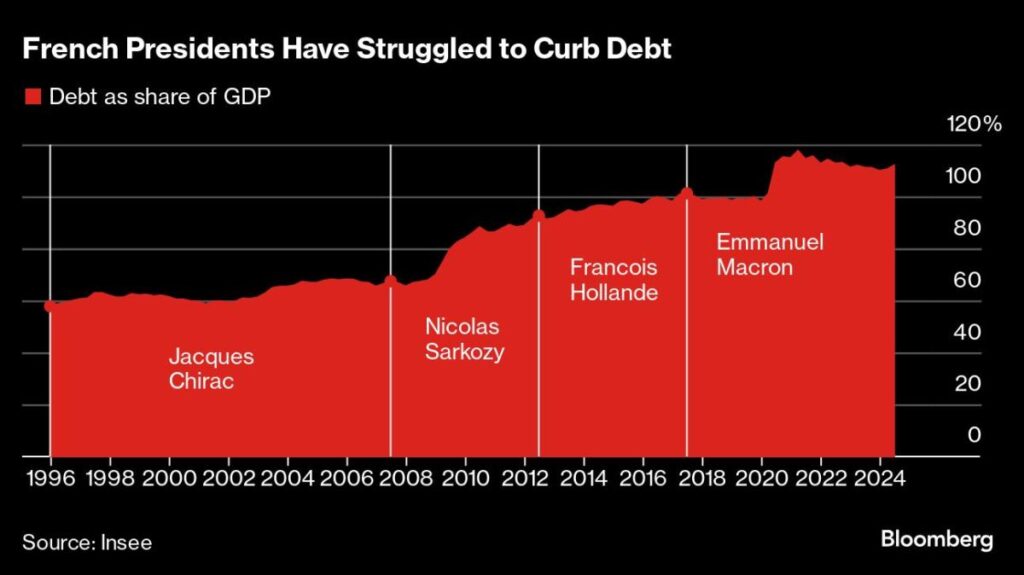

But Macron is being cornered. After the early elections he called in June, he no longer has a workable majority in parliament and the situation of French public finances has deteriorated considerably.

A massive fiscal adjustment is needed to take France’s budget deficit to 5% of economic output from around 6.1% this year, government officials said in a briefing to journalists on Wednesday, speaking on condition of anonymity in line with internal rules.

Prime Minister Michel Barnier said he is resorting to tax hikes as France’s debt problems push the country into the abyss. Political instability and budget uncertainty have prompted investors to dump French assets and the risk premium on sovereign debt is approaching its highest level since the eurozone crisis a decade ago.

Investors are now seeking an additional 79 basis points to buy French 10-year securities instead of German bunds – up from around 50 basis points before the election, although the spread reached as much as 86 basis points during the summer’s political turmoil.

Paris is by far the worst performing stock market in Europe this year, with French shares largely flat, while Milan, Frankfurt, Madrid and London can all make double-digit jumps. France’s CAC 40 blue chip index hit a record high in May but slumped and underperformed after Macron called early elections on June 9.

While the president acknowledged that tax increases may be necessary due to the situation, he said the top priority for the French economy is still boosting employment among the youngest and oldest workers. He warned that it is “super difficult” to cut social spending and that France has little room for maneuver on taxes, as the country already collects the most in Europe relative to the size of its economy.

“If we had the same level of activity as Germany, we would not have a government deficit,” he said. “It’s much smarter to work on that than to obsess over short-term adjustments that hinder growth.”

(Updates with French bonds in the eighth and ninth paragraphs.)

Most read from Bloomberg Businessweek

©2024 BloombergLP