Nikunj Tank, a worker in the diamond cutting capital of Surat in western India, has been in despair since losing his job in May.

The unit where he worked for seven years faced financial problems and closed, leaving him and more than a dozen others unemployed.

Tank was the family’s sole breadwinner; he supported his parents, wife and daughter and had no savings.

”He couldn’t find a job and couldn’t bear the loss. He took the extreme step,” said his retired father Jayanti Tank.

Tank died by suicide in August.

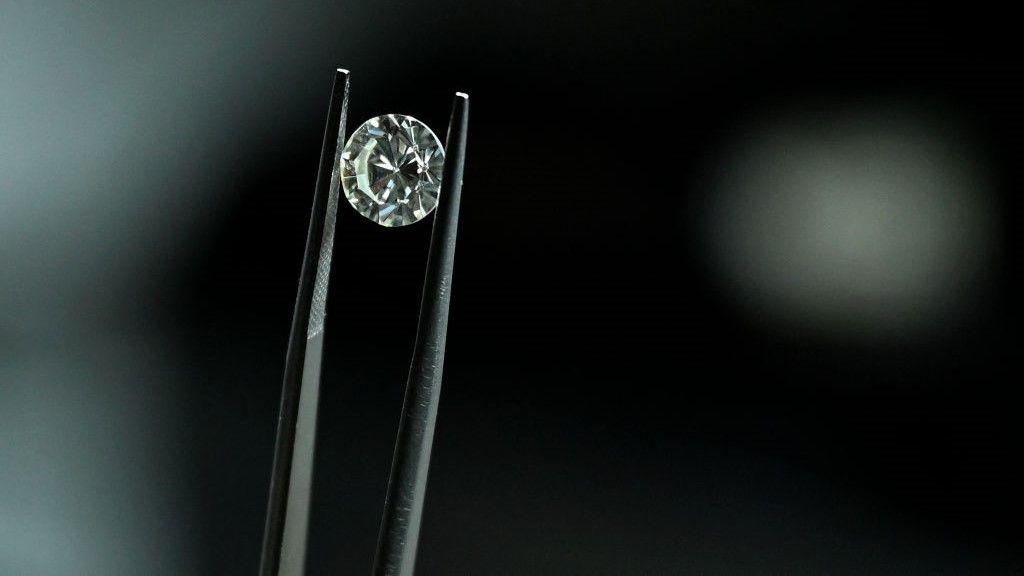

The past few years have been tough for the recession-hit Indian diamond industry. Surat, in the state of Gujarat, processes 90% of the world’s diamonds in more than 5,000 units and employs more than 800,000 cutters. The city has 15 major polishing units with an annual turnover of more than $100 million (£75 million).

India’s exports of cut and polished stones fell from $23 billion in 2022 to $16 billion in 2023 and are expected to decline further to $12 billion in 2024.

The price of polished diamonds fell 5% to 27% in 2023 due to lower demand and oversupply, analysts say. Mahesh Virani of Star Gems explained that oversupply occurred as polishing units continued production despite limited demand to keep operations running, ultimately increasing their losses.

The state’s Diamond Workers’ Union, a group representing cutters, told BBC Gujarati that more than 30,000 people have lost their jobs in the past six months alone due to the recession.

The says union that according to data collected from victims’ families, police records and news reports, 65 workers have died by suicide in the state in the last year and a half as a result of this slowdown. The BBC could not independently verify this figure.

Experts say the Covid-19 lockdown, the Russia-Ukraine-Israel-Gaza wars, and falling demand in key markets have had a negative impact on the Indian diamond industry.

“Polished diamond trade has fallen by more than 25-30% due to the global recession,” said Vallabh Lakhani, chairman of Kiran Gems, a leading manufacturer.

India imports 30% of its rough diamonds from Russian mines – which are now under Western sanctions because of the war – and cuts and polishes them, then sells most of them in Western markets.

In March, the European Union and the G7 countries imposed a new ban on the import of Russian unpolished diamonds, including diamonds processed in India and sold in the West via third countries.

After the new ban, India has publicly expressed his concerns, External Affairs Minister S. Jaishankar stated in April that such measures harm those lower in the supply chain more than Russia, as producers usually find alternative routes.

Traders in Surat confirm this.

“India is at the bottom of the diamond industry value chain. The country is highly dependent on the global market, both for raw materials and for final sales,” said exporter Kirti Shah.

Moreover, an economic downturn in the G7 countries and the UAE and Belgium – India’s top export destinations – is impacting business.

The downturn has also been attributed to a rise in demand for lab-grown diamonds, a cheaper alternative to natural diamonds, and the war in Gaza as the gemstones form a significant part of India’s trade with Israel.

“The diamond sector in Surat is going through a bad phase,” said Kumar Kanani, a lawmaker from the state’s ruling Bharatiya Janata Party (BJP). He said police are investigating suicide cases attributed to job losses.

“The government is ready to provide all possible assistance to polishers, traders and businessmen,” he said.

But the families of at least nine workers who recently took their own lives said they had received little help from the government.

The majority of layoffs occurred in small and medium-sized units, which typically hire workers for rough diamond quality control, polishing and shaping.

But bigger players are also affected. Last month, Kiran Gems asked its 50,000 employees to participate in one 10 day holidaywhere the delay is mentioned as the reason.

In July, the Diamond Workers Union started a helpline who received more than 1,600 emergency calls from polishers looking for work or financial assistance.

But there have been others who couldn’t get help in time.

Vaishali Patel, 38, lost her husband Nitin two years ago. The polishing unit he worked for had laid off most of its staff due to lack of turnover.

Brokers and traders are also bearing the brunt.

“We sat still for days. There is hardly any sale or purchase,” said Dilip Sojitra, one of 5,000 brokers in Surat who sell diamonds to customers, traders and other brokers.

Lab-grown diamonds, once in high demand, have also seen prices drop from $300 to $78 per carat due to overproduction, impacting the market. Surat Diamond Brokers Association chairman Nandlal Nakrani believes the situation will improve as rough diamond prices fall and polished diamond prices rise.

Despite the slowdown, some hope the industry will bounce back, as it did after the Great Recession of 2008, which closed hundreds of polishing businesses and left thousands unemployed.

Mr Sojitra said he believes the upcoming festival season, including Diwali, Christmas and New Year, will help boost business momentum.

“This too shall pass,” he says.