(Bloomberg) — Senegal, an emerging oil and gas producer, plans to spend about 12.8 trillion CFA francs ($21 billion) on development over the next five years and is targeting another CFA 5.7 trillion in private investment to achieve this, according to a draft of the government plan.

Most read from Bloomberg

According to the document, public investment in education, energy infrastructure and a range of other projects will increase by an average of 14.7% per year between 2025 and 2029, which is still a work in progress.

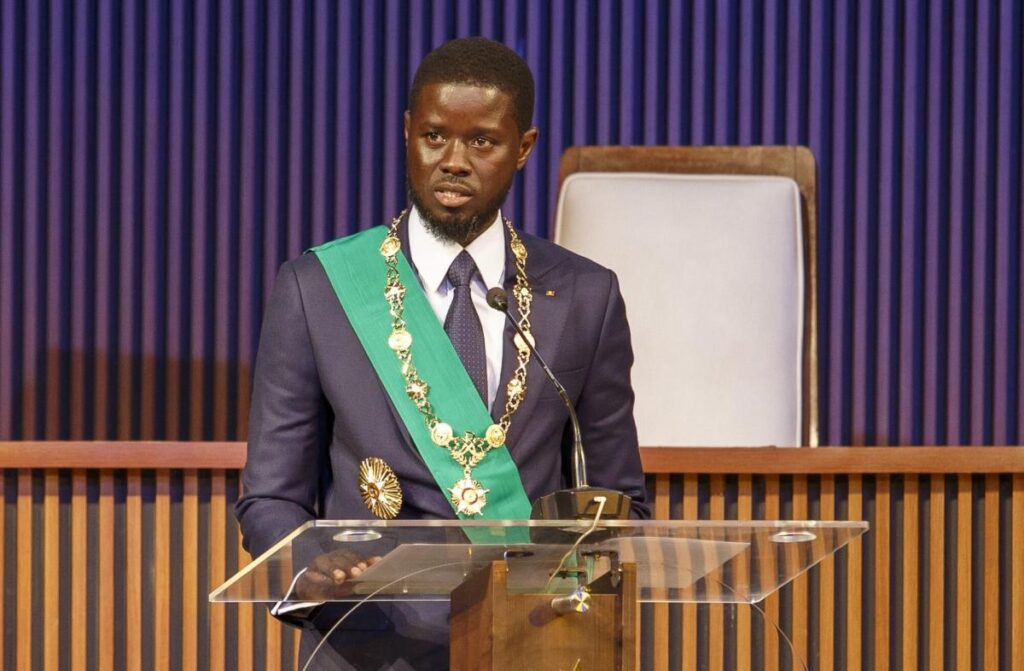

The plan is being formulated by the new government of President Bassirou Diomaye Faye, which took office in April and has pledged to tackle high levels of poverty and unemployment. It notes that a lack of transparency and poor management of public finances have hampered efforts to uplift Senegal’s 18 million residents, that wealth and income disparities between those living in the capital and in the countryside have increased and that the country has too high a debt burden.

“We will follow a new economic trajectory,” Prime Minister Ousmane Sonko said on Monday during a presentation of the plan in the city of Diamniadio. “In the next 25 years we expect a new economic landscape.”

About half of people in the West African country who do not live in major cities live below the poverty line, official youth unemployment exceeded 20% in 2022 and a fifth of eligible children are not in school, according to according to official data.

The government plans to generate more revenue from its oil, gas, gold and other natural resources in the future, while reducing its dependence on borrowing under a “prudent, better and more controlled debt policy,” it said plan. It projects that the country’s debt-to-gross domestic product ratio will fall to 61% by 2029.

A recent study found that the debt-to-GDP ratio during former President Macky Sall’s last five years in power averaged 76.3% – higher than the 65.9% reported by his administration. The budget deficit, meanwhile, averaged 10.1% of GDP, almost double what was previously estimated, the assessment said.

The government will prioritize the local and African markets in financing its budget deficit, and a quarter of the necessary financing will be raised through public-private partnerships, Souleymane Diallo, director of planning at the Ministry of Economy, said on Monday.

“Fifty-seven percent of the revenue goes toward servicing our debt,” and that will be reduced, he said.

While the plan says mining contracts and a fiscal framework for the oil and gas industry will be reviewed, it does not specify that terms will be renegotiated, as Faye’s government previously announced.

“Good governance is the first axis of our new approach,” said Sonko.

Other key takeaways:

-

The budget deficit will be reduced to 3% of GDP from next year and maintained at that level until 2025.

-

The average current account deficit is expected to decline by 4.1% of GDP over the next five years, down from 10.3% between 2014 and 2023, partly due to an increase in oil and gas exports and a gradual decline in food imports.

-

Energy subsidies are expected to fall to less than 1% of GDP in 2029, from 4% in 2020-2023, as increased use of gas to generate electricity helps keep costs under control and more cheaper crude oil becomes available for refining.

-

The tax ratio is expected to rise from 18% currently to 21.7%.

(Updates with government commentary from fourth paragraph.)

Most read from Bloomberg Businessweek

©2024 BloombergLP