(Bloomberg) — Kenya’s National Assembly has dropped a number of controversial tax proposals even as opposition lawmakers declined to participate in the vote for the bill that sparked street protests.

Most read from Bloomberg

Proposed levies on bread, mobile money transfers, banking services and motor vehicles were scrapped by ruling coalition lawmakers. They have also reduced a duty on imports of several goods, including diapers, sanitary napkins and rubber tires.

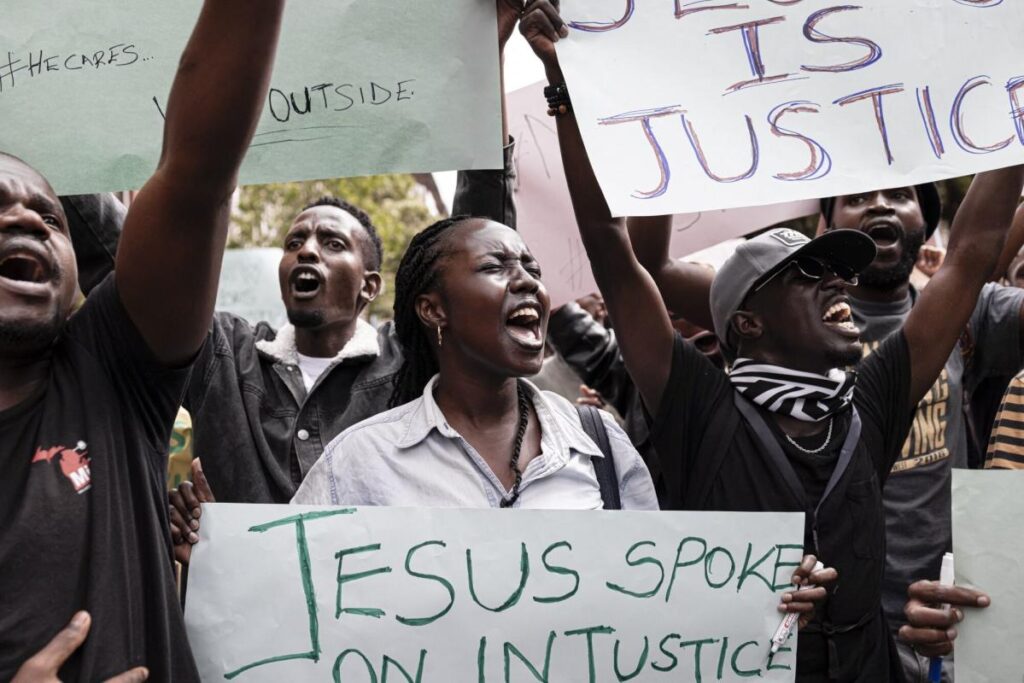

There were cries of “reject the bill” from the opposition, which wants the entire raft of new tax measures known as Finance Bill 2024 to be scrapped.

“You cannot change a bad bill,” said MP Otiende Amolo during the debate.

The National Treasury introduced the bill with the aim of raising an additional 302 billion shillings ($2.4 billion) for the 2024-2025 budget. If the government rolls back some of the levies a week ago, it will leave a funding gap of Shillings 200 billion, according to Finance Minister Njuguna Ndung’u.

To fill the gap left by the concessions, lawmakers approved an amendment to increase an import tax, the revenue from which will help finance the operation of a Chinese-built railway. The so-called rail development levy will now increase from 1.5% to 2.5%. There will be a new proposal to increase the fuel tax by 39%.

The concessions mean that the Ministry of Finance sees a financing gap larger than the 3.3% of gross domestic product it has budgeted for, compared to 5.7% in the current budget period.

To compensate, authorities may resort to borrowing more or introducing other tax measures. Under an International Monetary Fund program agreed in 2021, Kenya pledged to borrow less and cut government spending while boosting revenue collection.

According to the IMF, public debt – which amounts to around 67% of GDP – is at high risk of debt crisis.

–With help from Bella Genga.

(Updates with various tax measures from the first paragraph)

Most read from Bloomberg Businessweek

©2024 BloombergLP