(Bloomberg) — Japan’s buyers of liquefied natural gas — among the world’s largest — are struggling to ensure supply contracts are flexible enough and need the government to help negotiate better terms, said the head of an industry lobby group.

Most read from Bloomberg

So-called destination clauses that limit resale of shipments make it harder for companies to commit to decades-long contracts given uncertainty about future demand, Takashi Uchida, president of the Japan Gas Association, said in an interview Monday. Such restrictions are common in contracts with, among others, Qatar’s state producer, which does not want resold gas to dampen demand in other markets.

“We have asked the government to help free up clauses on the destination of contracts,” said Uchida, who is also chairman of Tokyo Gas Co. The private sector alone cannot create flexible agreements, he said.

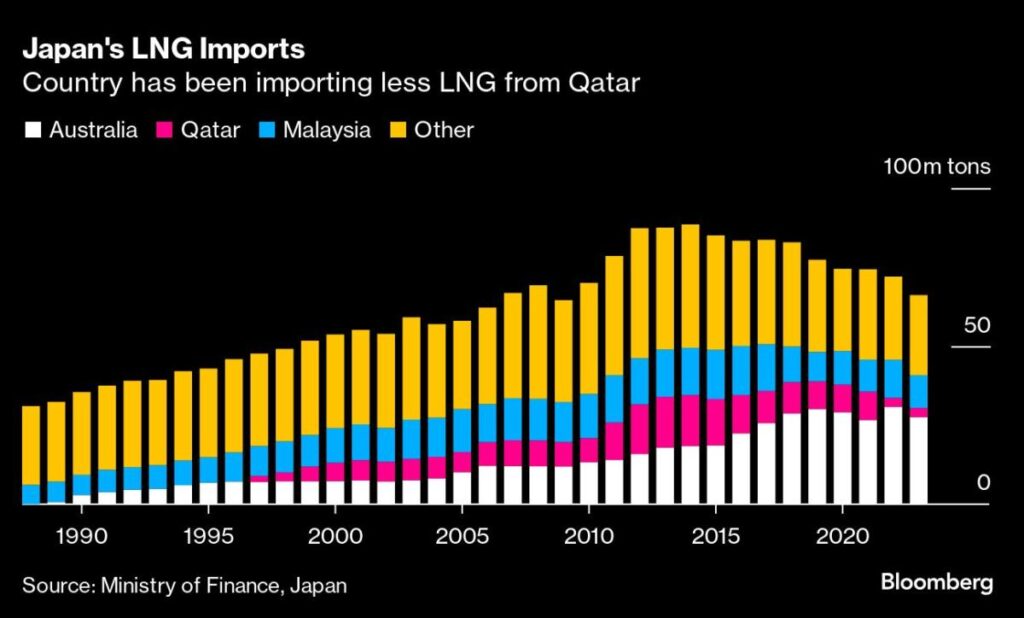

Japanese utilities are reluctant to sign new contracts with Qatar, which has an ambitious plan to boost LNG production and ensure the country remains a major player in the global market. Recent buyers of the Middle Eastern producer – including TotalEnergies SE and Germany – have hinted that there could be some flexibility in these terms as they look to limit fossil fuel use to meet climate targets.

Japan is a major player in the global LNG trade, and its electricity and gas companies have secured increased supplies from Australia and the US – which rival Qatar as the world’s largest transporter of super-chilled fuel. Both Jera Co. as Tokyo Gas did not renew contracts with Qatar when they expired in 2021.

Currently, Japan uses about two-thirds of the LNG it buys and sells the remaining third abroad. However, about 40% of long-term contracts are expected to still have destination clauses in 2030, according to an analysis conducted by the Japan Organization for Metals and Energy Security.

The Asian country currently gets about 70% of its electricity from fossil fuels, including natural gas and coal, and is revising its strategic energy plan, which could dictate the energy mix after 2030. Despite a shrinking population, there are predictions that artificial intelligence and data centers could boost electricity consumption.

“It will be difficult to supply data centers with sustainable energy,” Uchida said, adding that LNG-fired power is currently the most realistic solution to provide stable electricity to energy-hungry facilities.

Most read from Bloomberg Businessweek

©2024 BloombergLP