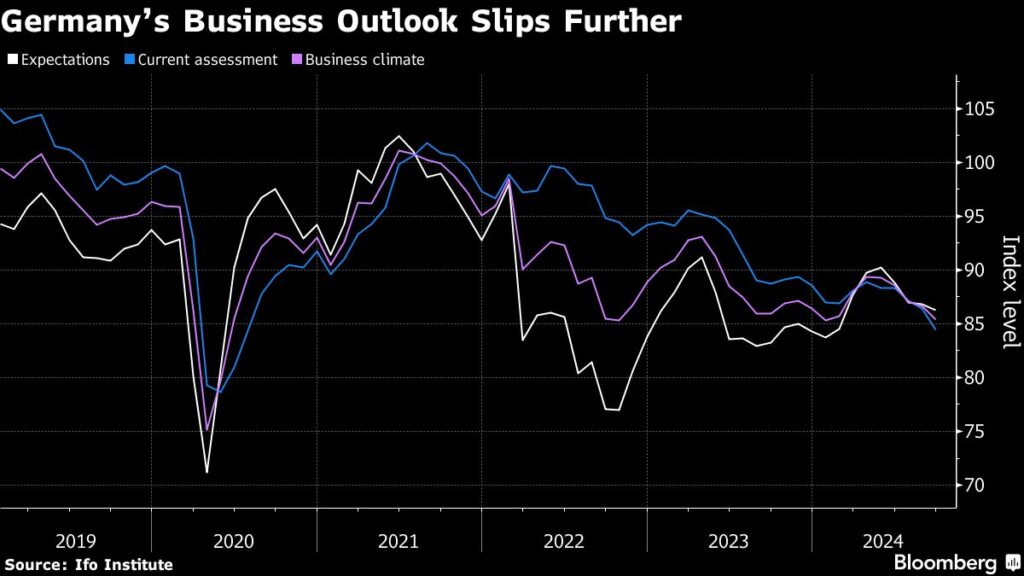

(Bloomberg) — Germany’s economic outlook has deteriorated again, fueling fears that Europe’s largest economy is in recession with no quick recovery in sight.

Most read from Bloomberg

The Ifo Institute’s expectations gauge fell to 86.3 in September from 86.8 the previous month. That’s still the lowest level since February and slightly below what analysts saw in a Bloomberg poll. A barometer of current conditions fell more sharply.

“The biggest weakness is really manufacturing, which is so important,” Ifo President Clemens Fuest told Bloomberg Television on Tuesday. “We are really seeing this weakness everywhere — machinery, chemicals, electrical equipment, autos. Companies are telling us that we have a lack of orders. And now on top of that we have weaknesses in the services sector.”

Talk of Germany’s economic downturn is growing louder after a string of bad news highlighted weaknesses in its key auto sector. The disappointing performance is weighing on the eurozone as a whole, with an early annual recovery in the 20-nation bloc fading.

While the Bundesbank insists a serious economic downturn seems unlikely, it has warned that Germany may already be in recession, with a fresh contraction possible in the third quarter after a 0.1% fall in the second. President Joachim Nagel is due to deliver a speech on the economy later on Tuesday.

S&P Global reported Monday that its latest purchasing managers’ index for Germany fell more than expected to 47.2, the lowest level in seven months and well below the 50 threshold that separates growth from contraction.

Economists have already begun to cut their forecasts for this year, with some now seeing stagnation or even a slight decline. Germany, which has suffered in particular from weak demand in China, was the only Group of Seven economy to contract in 2023.

“We can’t rule out that we’ll end this year with a negative growth figure,” Fuest said. “A lot depends on consumption and that could have an opposite effect. So far, we’re seeing rising disposable incomes, but that’s not translating into consumption. So the savings rate has increased, which suggests that people might be worried about the future.”

The problems facing Germany and the wider implications for the continent are prompting market bets that the European Central Bank will cut rates again as early as next month, rather than waiting until December, as several officials have recently suggested.

“Parts of the eurozone economy are in free fall, others are simply losing momentum – it is clear that interest rates are too high to allow investment spending and growth to pick up,” said Karsten Junius, chief economist and head of economic and strategic research at Bank J. Safra Sarasin in Zurich.

“The ECB should reconsider the case for front-loading policy rate cuts, similar to the Fed,” he said.

–With assistance from Joel Rinneby, Kristian Siedenburg, and Tom Mackenzie.

(Updates with Fuest comments from the third paragraph.)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP