(Bloomberg) — Droughts, downpours and fires from Asia to the Americas are fueling crop concerns, pushing up food prices that could ultimately translate into higher grocery bills.

Most read from Bloomberg

The Bloomberg Agriculture Spot Index – which covers nine major products – posted a monthly gain of more than 7%, the highest since Russia’s invasion of Ukraine sent markets soaring in early 2022. Although the index is still far from that year’s peak, the rally is coming as farms. from Brazil to Vietnam and Australia are experiencing flooding and extremely dry weather, endangering sugar, grain and coffee.

“We have recently seen a confluence of worse weather conditions that have pushed prices higher” as supply uncertainty means buyers are willing to pay more, said Michael Whitehead, head of agribusiness insights at ANZ Group Holdings Ltd.

That marks a turnaround from earlier this year, when food prices were largely kept in check by healthy supply and declining demand in key markets such as China. If the recovery continues, it could impact prices in supermarket aisles, said Dennis Voznesenski, associate director of sustainable and agricultural economics at the Commonwealth Bank of Australia.

The agricultural index tracks the staples used to feed livestock, sweeten drinks and bake bread. Smaller crops such as cocoa – essential for chocolate makers – are also up in 2024 after shortages in West Africa, and weather disruptions have sent vegetable costs soaring in some countries.

Wheat futures in Chicago rose in September on concerns that bad weather at major exporters could further undermine global inventories, which are already on track to a nine-year low. Australian fields are threatened by both drought and frost, and a lack of rain in the Black Sea region is hampering planting for next year’s harvest.

Meanwhile, soybean futures posted their biggest monthly gain in two years as top grower Brazil faces its worst drought in decades. Dry conditions – which have limited early seeding pace – are expected to persist in some areas, forecaster Maxar said in a note on Friday. Fires also broke out in the country’s sugar cane fields, sending futures for the sweetener up about 16% this month.

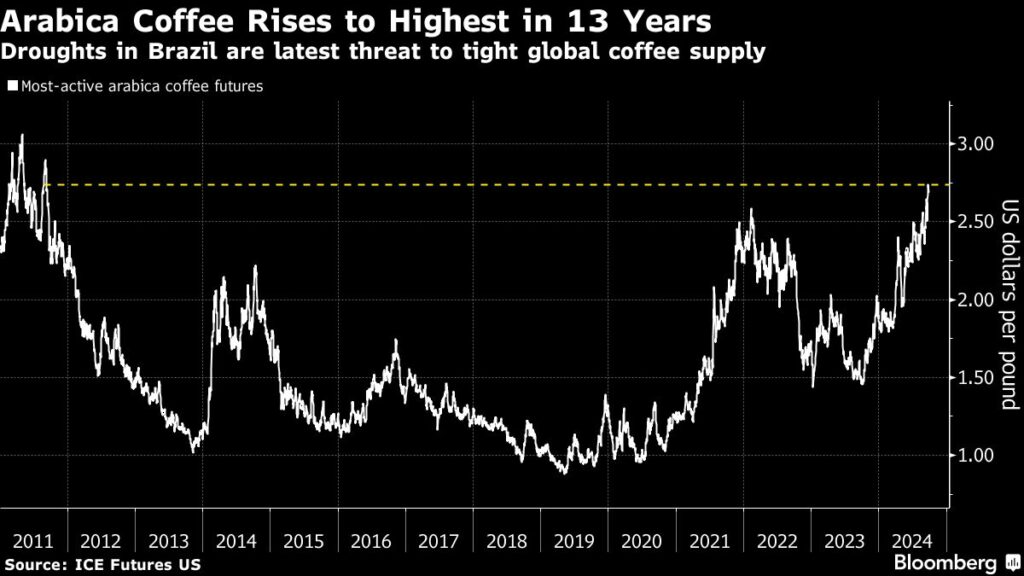

Arabica coffee climbed to its highest level since 2011 as bad weather there also affects trees during the crucial flowering period. The usually cheaper Robusta coffee variety is also affected by the bad weather, which means it is now almost as expensive. Drought in Vietnam’s coffee belt, followed by heavy rain as harvest approaches, has negatively affected the major grower’s production.

And elsewhere in Southeast Asia, palm oil supply is shrinking as trees age, sending futures to a five-month high and a rare premium over rival soybean oil.

All that means more pain throughout the supply chain — from farmers struggling with coffee bean theft to consumers spending more money for burgers. And hedge funds are betting on further gains, increasing net bullish bets on sugar, soy meal and cocoa from September 24, government figures show.

Drought in much of northern and central Brazil will likely continue to threaten crops in the heavy farming sector, JPMorgan Chase & Co. analysts said. in a report last week. In addition, traders are keeping an eye on tensions in the Middle East and the Black Sea and how the outcome of the upcoming US elections affects trade relations with China, Whitehead said.

“There is a fair amount of volatility that is keeping the markets awake,” he said. “Keep one eye on the sky and the other eye on the politics.”

–With help from Michael Hirtzer.

Most read from Bloomberg Businessweek

©2024 BloombergLP