(Bloomberg) — French central bank Governor Francois Villeroy de Galhau said the country urgently needs to address its deficit and debt problems as bond markets increasingly warn of the risks.

Most read from Bloomberg

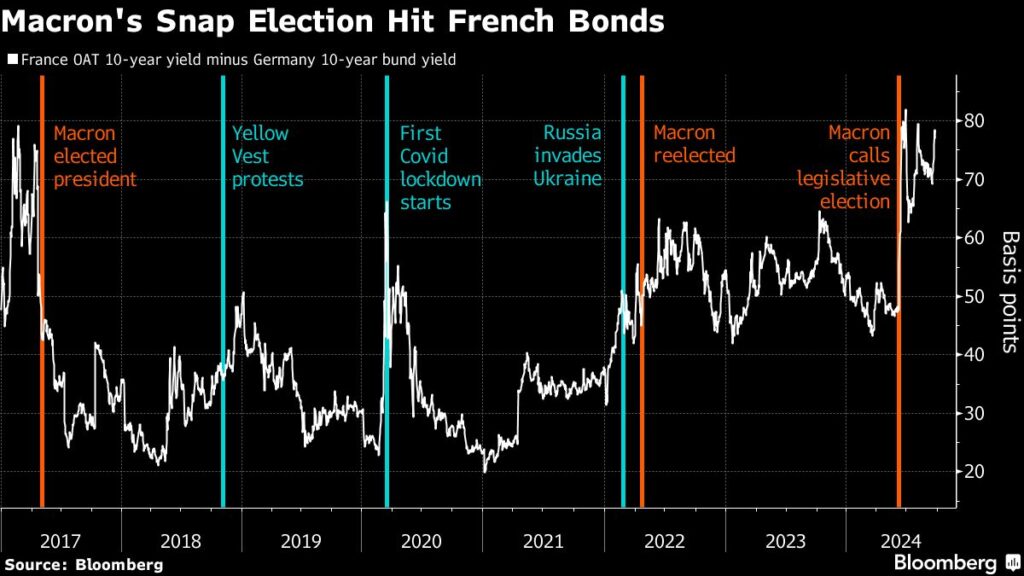

“In recent days, international lenders, those who lend to France, have also told us that we have to react now,” he said on France 2 television on Wednesday. “Before June, we had an interest rate differential with Germany of around 0.5 percentage points, and now we are close to 0.8, so we really have to deal with this disease.”

The French government is under pressure to find quick solutions to the country’s fiscal challenges and must present a 2025 budget bill to parliament in the coming weeks. Prime Minister Michel Barnier said on Sunday he would raise taxes on the country’s biggest companies and wealthiest individuals in an effort to tackle the country’s massive budget deficit — an approach Villeroy has backed.

“When a family is living beyond its means, as is the case in France, you can either reduce expenditure or increase income,” Villeroy said. “Today we have to do both — we need a well-proportioned cocktail.”

He said savings should account for three-quarters of the effort. The central banker added that France is in a “relatively favourable” situation for fiscal consolidation as inflation falls, real incomes improve and interest rates fall.

“For 40 years we have been saying that it is not the right time and that we should not break growth – the result is that the public debt is getting out of control,” Villeroy said. He added that France will soon be the only country in Europe that cannot bring its deficit within the European Union ceiling of 3% of economic output.

In an unexpected bright spot for Prime Minister Michel Barnier’s new government, data from statistics agency Insee showed on Wednesday that French consumer confidence rose in September to its highest level since February 2022, the month Russia invaded Ukraine. The reading was higher than any economists had estimated.

Insee reported earlier this month that French economic growth will be modest on average in the second half of the year, as consumer demand increases only slightly and companies, struggling due to political uncertainty, remain cautious about investing.

(Updated with consumer confidence in the seventh paragraph.)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP