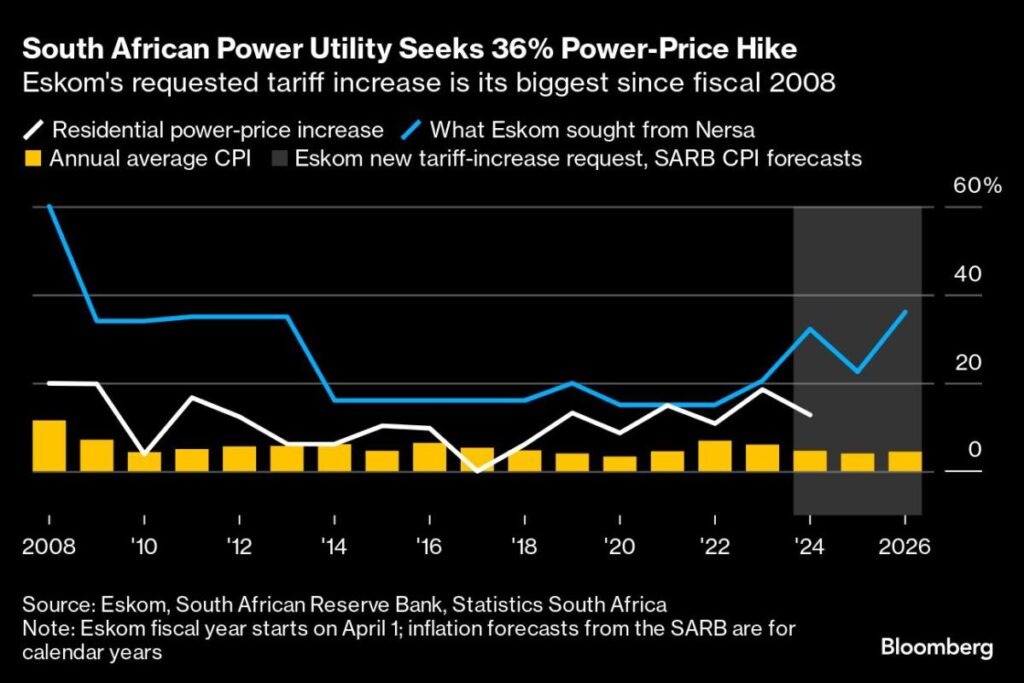

(Bloomberg) — South Africa’s state-owned energy company said it had to ask for a 36% price hike because of the government’s inability to rein in delinquent municipalities and because of the regulator’s mistakes in reviewing previous requests to increase rates.

Most read from Bloomberg

Eskom Holdings SOC Ltd., which is receiving a 250 billion rand ($14 billion) bailout package from the government, said the increase is necessary to prevent the indebted company from returning to authorities for further financial assistance. The increase would apply for the 12 months to March 2026 and would be followed by increases of 11.8% and 9.1% for the next two years.

“We aim to be more self-sufficient and not remain a burden on us,” Hasha Tlhotlhalemaje, general manager for regulatory affairs, told reporters at a briefing on Monday.

The increase, which is said to contribute to a 600% increase in electricity prices since 2006, has drawn criticism from civil society, municipalities and the government. Electricity and Energy Minister Kgosientsho Ramokgopa said earlier this month that it would undermine economic growth and deepen poverty and that the government could intervene to keep prices lower.

The utility, which has about 400 billion rand in debt, was previously a lightning rod for anger at the government as it imposed regular power cuts due to poor maintenance and suffered a series of bribery scandals.

The company has improved power plant performance this year, with the last planned outage in March, but is sparking new controversy over the planned tariff increase, which compares to 4.4% inflation. While the increase would give Eskom annual revenue of 446 billion rand, this is still less than the 73% increase that would be required to achieve a return on assets equal to the weighted cost of capital.

“We are not a bundle of household goods,” Tlhotlhalemaje said, saying the comparison with inflation was inadequate.

Tlhotlhalemaje and Eskom chief financial officer Calib Cassim also said the huge increase was necessary because South Africa’s National Energy Regulator has consistently made mistakes in assessing its requests and granting increases that do not reflect costs.

“There was clear incompleteness, that’s a polite word for mistakes, in the decisions Nersa made,” Tlhotlhalemaje said, adding that the inadequate increases had built up a deficit that now needs to be made up. As a condition of the bailout, the company must seek permission from the National Treasury to take on more debt, a method it has used in the past to reduce price increases.

Municipalities, including those governing some of the country’s largest cities, owe the utility R85 billion and that could rise to R200 billion in fiscal 2028, Cassim said. Of the 72 municipalities that have signed a debt forgiveness program, only 14 are meeting payment obligations, he says.

“This is unsustainable,” he said. “The government must address this.”

Other concerns included agreements with metal smelting companies such as South32 Ltd. and Glencore Plc giving them discounted electricity and an incoming carbon tax that will cost the company R21.3 billion in the 2027 financial year.

About half of the factors underlying the price proposal were within the company’s control, while the others were out of its control, executives said.

Unless adequate increases are granted “it will all come to nothing” and the company will need further bailouts, Tlhotlhalemaje said. “Short-term pain for long-term gain. This is what this exercise is all about.”

(Updates with details on municipal debt in 10th)

Most read from Bloomberg Businessweek

©2024 BloombergLP